AML High-Risk Third Country Lists and Why Businesses Need to Know Them

What should businesses know about high-risk countries in terms of anti-money laundering regulations? This article covers the key points so you can stay compliant.

Money laundering (ML) and terrorist financing (TF) are increasingly global threats. To fight back, governments adopt anti-money laundering/counter-terrorist financing (AML/CFT) legislation and put legal and regulatory processes in place.

AML/CFT legislation obligates businesses to identify, assess and understand the ML and TF risks to which they may be exposed. However, such legislation is not equally strict across different jurisdictions. So, where AML/CFT standards are weaker, you’ll see higher levels of corruption and illegal market operations (and vice-versa).

Still, there are popular investment opportunities in countries with low AML/CFT standards. And the many companies considering such markets should, therefore, be particularly well-equipped to assess ML/TF risks. Otherwise, they face very real risks of getting tied up in money laundering or terrorist financing schemes, imperiling their business.

What are AML high-risk countries?

“High-risk” countries are those with significant deficiencies in their money laundering countermeasures, a significant level of corruption according to the Transparency Index list, and/or a designation as such by the Financial Action Task Force ( FATF). These countries are subject to increased monitoring and are included into various lists of governments and international bodies (e.g. FATF “graylist” and “blacklist”, the Basel AML Index and the high-risk country ratings of European Union, United Kingdom and the United States).

The FATF is the main international body identifying countries with strategic AML/CFT shortcomings. It compiles multiple lists, such as the High-Risk Jurisdictions Subject to a Call for Action and Jurisdictions under Increased Monitoring, which are updated three times a year. The FATF works with high-risk countries to mitigate those shortcomings that pose a risk to the international financial system.

The European Union, UK and US have their own high-risk country lists in accordance with FATF standards. These lists are almost the same as FATF lists because they follow the same logic.

The EU AML directive sets four categories of high-risk countries:

- countries that don’t have effective AML/CFT systems;

- countries exposed to the high level of corruption and criminal activity;

- countries under sanctions;

- countries financing terrorism or having terrorist organizations on their territories.

Regulated businesses are supposed to determine their own risk appetite based on the above criteria.

Why high-risk country ratings matter

Regulated financial institutions are legally required to follow international and local AML/CTF standards. This means obtaining the full range of required information and identifying all relevant risk factors before commencing a business relationship, and applying additional CDD measures if needed.

It’s necessary to apply Enhanced Due Diligence (EDD) measures in business relationships and transactions involving high-risk third countries. This requirement is common for all high-risk third countries, however the scope of the EDD measures necessary may vary.

All in all, high-risk country ratings help businesses determine risks associated with customers, corporate customers and transactions and take necessary precautions.

What countries are considered high-risk for money laundering?

There are various means of determining high-risk countries, including the FATF “blacklist” and “greylist”, the Basel AML Index and high-risk country ratings maintained by governments such as the UK and EU.

FATF “blacklist” and “greylist”

FATF works with high-risk countries to address strategic shortcomings in their AML/CTF regimes, dividing those countries into two lists: High-risk jurisdictions subject to a call for action (“blacklist”) and Jurisdictions under increased monitoring (“greylist”).

The FATF “blacklist”: High-risk jurisdictions subject to a call for action.

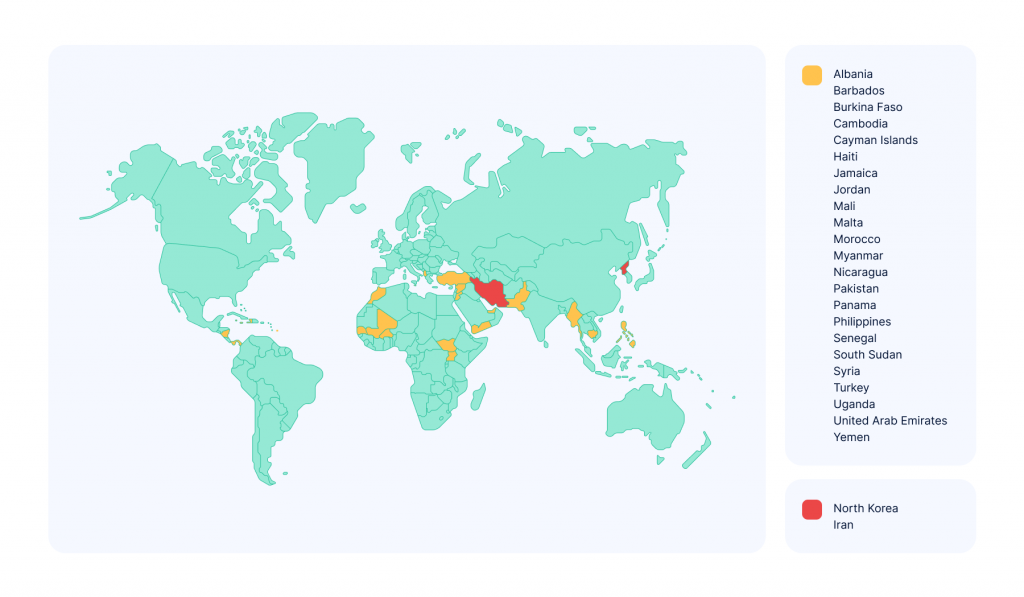

For dealings in countries identified as very high-risk, the FATF calls on all members to apply EDD measures. In the most serious cases, member countries are called upon to apply counter-measures to protect the international financial system from the ML/TF risks emerging from such countries. Since 2020, this list includes only two countries: North Korea (Democratic People’s Republic of Korea) and Iran.

The FATF “greylist”: Jurisdictions under increased monitoring.

When the FATF places a jurisdiction under increased monitoring, it means the country has committed to resolve its strategic shortcomings within agreed timeframes and is subject to increased monitoring. The FATF welcomes the progress made by “greylist” countries in combating money laundering and doesn’t impose tough sanctions on them. However, these countries may still face economic sanctions from institutions like the International Monetary Fund (IMF) and the World Bank, and experience adverse effects on trade. In any case, regulated financial institutions such as banks need to be closely monitored in such countries.

Countries are regularly added to the greylist, while those that successfully address their shortcomings are removed.

As of March 2022, the FATF greylist includes the countries above

Following its most recent review, the FATF now identifies the United Arab Emirates as high-risk. Following improvements in its AML regime, Zimbabwe is no longer subject to the FATF’s increased monitoring process. These are just two examples of how such ratings can shift country by country, which is why it’s important to have an effective monitoring system in place.

The Basel AML Index

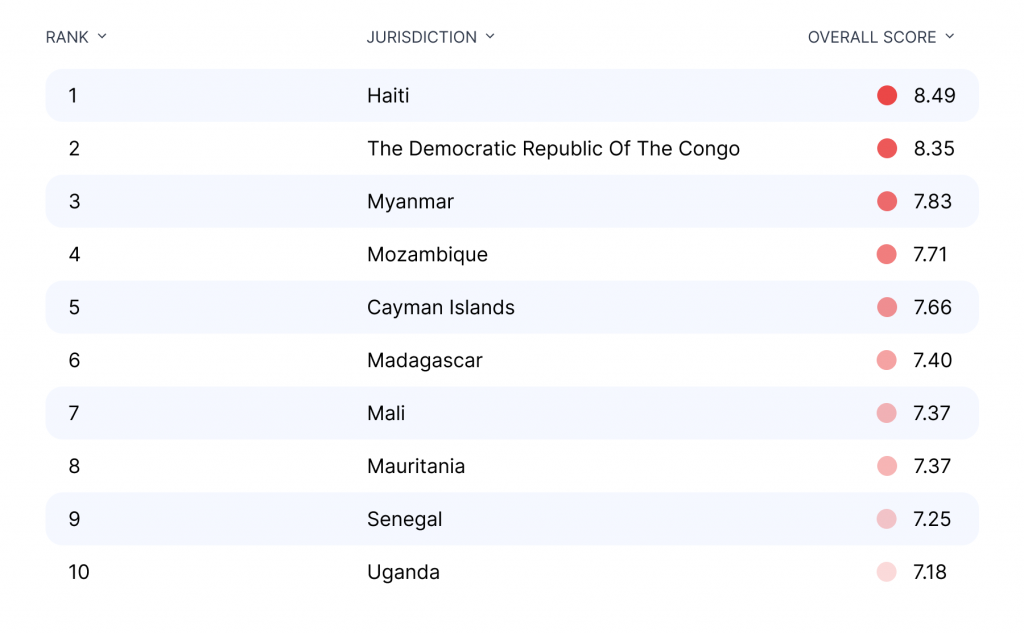

The Basel AML Index is an independent country ranking and risk assessment tool for money laundering and terrorist financing (ML/TF) maintained at the Basel Institute on Governance. Based on data from publicly available sources such as the FATF, Transparency International, World Bank and World Economic Forum, the Basel AML Index measures overall ML/TF risk in countries around the world.

The aim of this index isn’t to divide countries into “good” and “bad” categories. Rather, it measures risks to determine a given jurisdiction’s regulatory exposure to ML/TF and its ability to counter it. The AML Index is based on 5 key factors with different density, including:

- quality of AML/CFT framework (65%)

- corruption and bribery risk (10%)

- financial transparency and standards (10%)

- public transparency and accountability (5%)

- political and legal risk (10%)

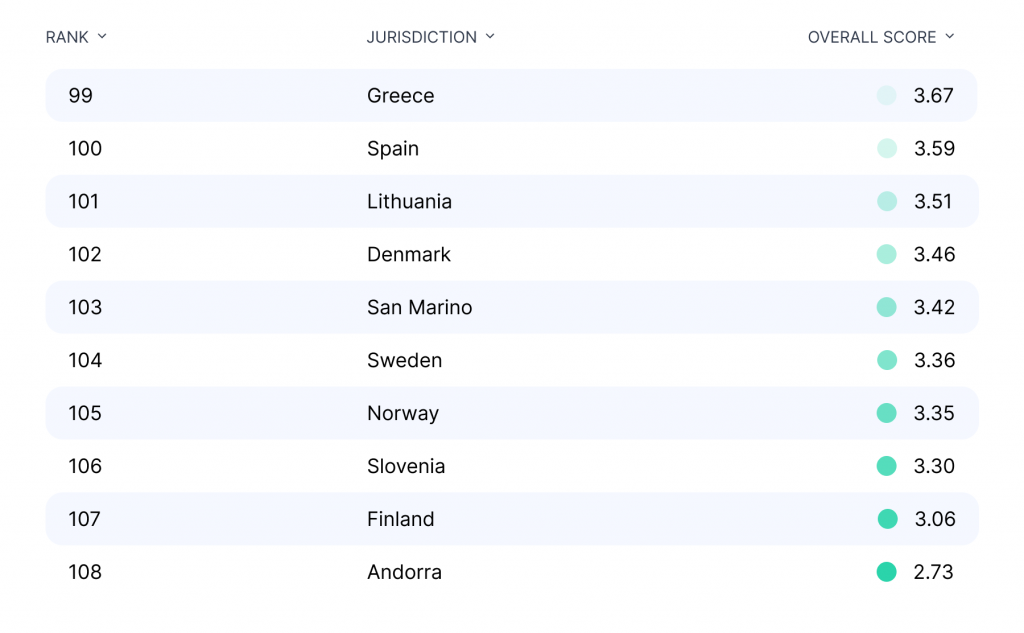

In 2021, the Basel AML Index provided a detailed overview of 110 jurisdictions and determined risk scores according to the available data.

The top 10 jurisdictions with the highest ML risk scores (Basel AML Index, 2021)

The top 10 jurisdictions with the lowest ML risk scores (Basel AML Index, 2021)

So, Haiti turned out to be a jurisdiction with the highest ML risk index (8,49) while Andorra got the lowest risk score (2,73).

United Kingdom high-risk country rating

On March 29th, 2022, HM Treasury published an amended list of high-risk third countries. This list continues to mirror both the Financial Action Task Force’s (FATF) “Jurisdictions under increased monitoring” and “High-risk jurisdictions subject to a call for action” lists.

European Union high-risk country rating

Under the 4th Anti-Money Laundering Directive, the European Commission is empowered to identify high-risk third countries with strategic AML/CTF shortcomings. In January, 2022, the European Commission updated its regulations regarding high-risk third countries that pose significant threats to the financial system of the Union. Accordingly, the following 23 countries are identified as having strategic deficiencies in their AML/CFT regimes:

European Union high-risk country rating

The European Commission considers Iran as a high-risk country with a high-level political commitment to addressing its identified shortcomings. Therefore, the Commission has decided to seek technical assistance in the implementation of the FATF Action Plan for Iran. North Korea, however, still presents significant ongoing ML/TF risks.

Both the FATF greylist and EU high-risk country list contain 23 countries. However, these lists don’t mirror each other. For example, the EU list places Afghanistan first, and includes Trinidad and Tobago, Vanuatu and Zimbabwe, while the FATF list includes Albania, Turkey, United Arab Emirates and Malta. North Korea is considered as a substantially high-risk country in both lists, and Iran is on its way to improvement according to the European Commission.

Sumsub has already written a series of detailed articles on AML in various jurisdictions and industries. Check out our guides to get an in-depth understanding of each jurisdiction:

AML/KYC Guide to The UAE—New Laws and Regulations for 2022

Turkey Enacts Its First Crypto Regulations: Here’s How Businesses Can Adapt

How to protect your business

Each regulated entity should take appropriate steps to identify and assess ML/TF risk factors, including those related to its customers, countries and geographical areas.

When companies deal with customers from high-risk third countries, they should be aware that:

- high-risk countries may be subject to financial sanctions, which require companies to take additional measures;

- regulators worldwide require companies to apply EDD measures in any transaction or business relationship with a person established in a high-risk third country.

However, this doesn’t mean that customers from high-risk countries are automatically involved in criminal activities; rather, they indicate higher risk factors that warrant closer attention.

Also, companies are required to assess risk factors related to suspicious customer interactions from high-risk countries by:

- applying the risk-based approach to determine whether enhanced due diligence is required;

- screening through sanctions lists, global watchlists, Politically Exposed Persons (PEPs) lists, adverse media and other similar sources.

Enhanced Due Diligence is an in-depth verification procedure for high-risk situations (i.e. dealing with customers from high-risk countries, PEPs, cross-border correspondent relationships with a third-country, high transaction amounts, etc.). It requires additional checks, such as verification of sources of wealth and funds.

This advanced check doesn’t mean that all customers form ‘high-risk’ should be banned automatically. However, they should have to provide additional information.

Learn the detailed EDD procedure in our updated article Enhanced Due Diligence (EDD): the Risk Indicators and Procedures.

Frequently Asked Questions

-

What countries are considered high-risk for money laundering?

Generally, the FATF greylist is considered a legislatory standard. The Basel AML Index 2021 provides the average risk score of 110 jurisdictions, depending on regional and income classifications.

-

Which country has the highest risk of money laundering?

According to the FATF lists, Iran and North Korea have failed to address shortcomings in their AML/CFT regimes. Albania needs to continue implementing its action plan to address its strategic deficiencies. The FATF continues to closely monitor these countries.

-

Is China a high-risk country for money laundering?

China is not included in the FATF’s high-risk country lists. The Basel AML Index 2021 gives China a 6,70 overall risk score out of 8,49. This means that the region’s risk average is slightly higher than the global average.

-

Is Dubai a high-risk country for money laundering?

Dubai is the capital of the Emirate of Dubai within the United Arab Emirates. As of March 2022, the FATF identifies the United Arab Emirates as a high-risk country.

-

Is Switzerland a high-risk country for money laundering?

Switzerland isn’t included in the FATF’s high-risk country lists. According to the Basel AML Index 2021, the country’s overall risk score is 4,89 out of 8,49, which is relatively high.

Conquer AML requirements in high-risk third countries with Sumsub’s automated solutions and legal expertise. Get a demo today!

Explore more

- Regulatory compliance

- Dec 21, 2023

- 10 min read

- Verification

- Dec 14, 2023

- < 1 min read