What’s Money Muling and How Does It Affect Businesses?

Money muling is a form of money laundering where criminals employ other individuals to move illicit funds.

COVID-19 has led to widespread unemployment, which has made it easier for criminals to recruit money mules. In 2020, authorities identified over 100,000 money mules in the UK and US alone.

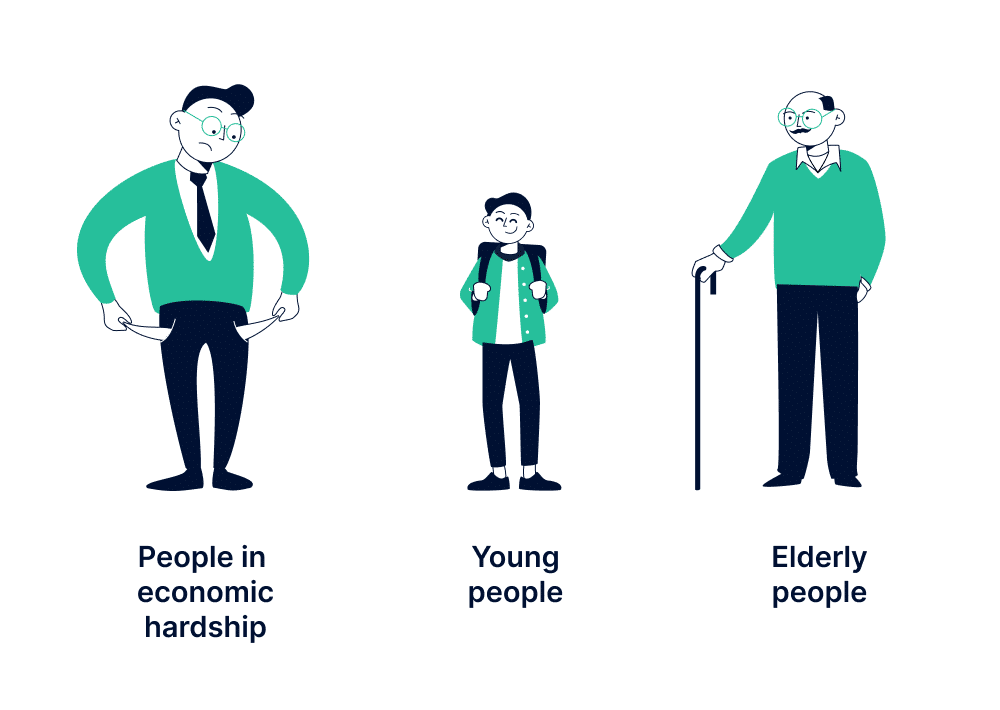

Most targeted groups for money muling

Who’s a money mule?

A money mule is a person retuited by criminals to launder illicit funds. Mules usually have a clean banking history and no criminal record. This allows them to move criminal money without getting noticed.

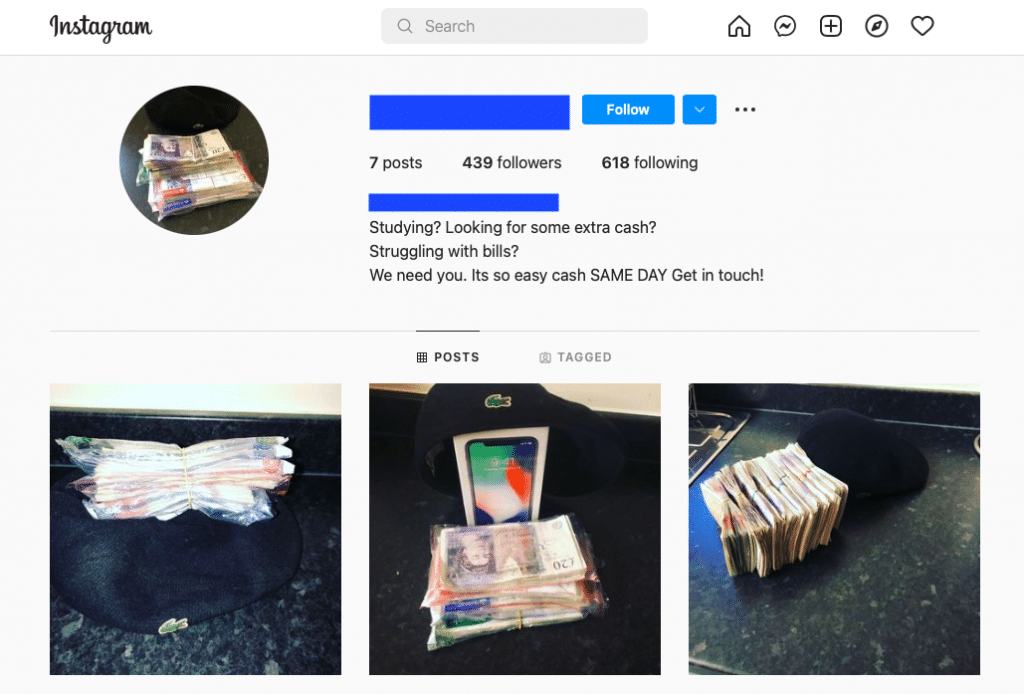

Money mules are recruited through online job offers, dating sites, or darknet forums. Recruiters can lure individuals by promising easy money or creating job adverts that appear like legitimate offers.

Here’s an Instagram account of a potential mule recruiter. Such recruiters often take pictures of large sums of money and promise easy cash to lure young people

Europol, an organization that fights terrorism and other organized crimes, describes the categories of people most often targeted for money muling.

People in economic hardship. These include unemployed individuals, students, and immigrants. This demographic increased significantly as a result of the pandemic.

Young people. Criminals target young individuals the most, sometimes even recruiting teenagers. In 2020, the recruits of people under 21 more than tripled, according to Barclays.

Elderly people. In a recent shift in mule recruiting activity, Cifas reported a 34% increase in money muling among 40–60-year-olds in 2021.

FBI: Glenda, an 81-year-old victim of a romance scam, describes how she became a money mule and is now paying the price

All in all, businesses should conduct proper due diligence for all age groups, even for elderly customers who look the least suspicious.

Criminals can also open business accounts for money muling. In 2020, there was a 26% increase in such accounts compared to the previous year. Criminals use business accounts to move large sums to make them appear less suspicious.

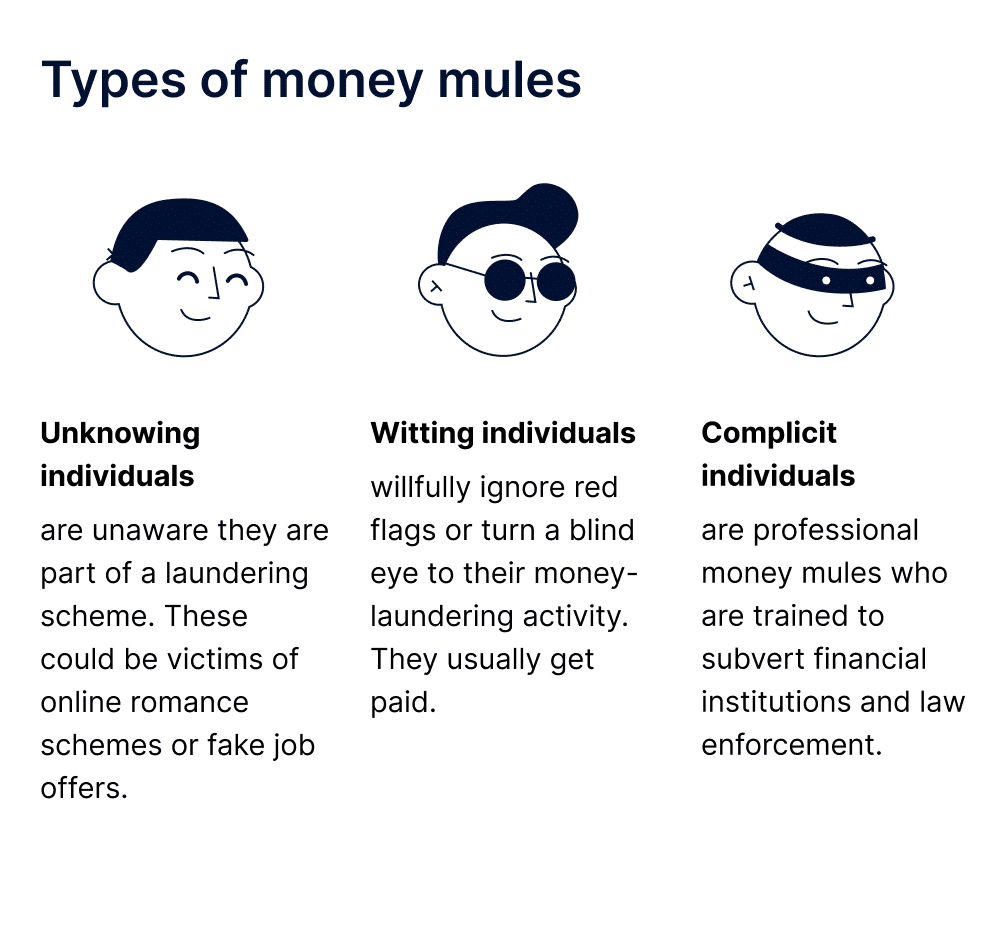

Types of money mules

Some money mules know they are supporting criminals while others are unaware. According to the FBI, money mules can be divided into three types.

Feel free to save this picture to your device

The BBC reported on a young woman who became a witting money mule. When Holly (not her real name) was still in school, she was approached on social media by a person who promised to pay her for letting him use her bank account. She knew it was suspicious but handed over her bank card anyway.

“He was convincing me. He showed me other people that he’s worked with about how much money they got and he just kept on pestering me for my card and I just eventually gave in,” she told the BBC in a radio interview.

The story didn’t end well for Holly. She was soon discovered and blocklisted from all banking services for at least six years.

Serving as a money mule damages one’s credit and financial standing. Consequences include closure of payment accounts, loan and credit denial, difficulties getting a phone contract, and others. Also, law enforcement agencies warn that muling is a serious crime that can lead to up to 14 years of imprisonment in the UK and 30 years in the US.

If an individual suspects that they might be a mule, they must stop communicating with the criminal and warn the police.

How criminals launder money through money mules

In 90% of cases, criminals use money mules to launder proceeds from cybercrime, including malware and romance schemes. It could also be from something more vicious, like human and drug trafficking.

The FBI explains that money mules can move funds through bank accounts, cashier’s checks, virtual currency, prepaid cards, or money service businesses. This helps criminals avoid Customer Due Diligence (CDD) procedures, hiding their identities and sources of funds.

Money muling works like this:

- Criminals recruit a mule through an online job or dating site;

- The mule opens an account with a bank or other financial platform or uses their existing account;

- Money is sent to the mule’s account from a criminal source, such as a fake company;

- The criminals instruct the mule on when and where to move the money. They can request the mule to make a wire transfer or give account access to another person;

- The money mule gets a cut for their participation.

It’s harder to track illegal money movement involving unknowing individuals, who usually have verified payment accounts classified as low-risk. Such accounts are subject to less monitoring, which increases the chance of fraudulent transactions going unnoticed.

A real-life story about a Russian rapper who worked as a money mule and helped a criminal syndicate to launder money (step-by-step breakdown of the laundering scheme)

How to detect money mules

It’s hard to catch money mules, especially at the onboarding stage, since these are usually ordinary people with a clean banking history. Therefore, it’s useful to employ automated transaction and profile monitoring that can notice even slight changes in customer behavior.

Detecting mules during onboarding. Professional money mules can use stolen identities to open accounts on financial platforms. Therefore, businesses need to conduct a proper CDD procedure that verifies the customer and their documents, assigns a behavioral risk score, searches blocklists, and performs adverse media screening.

Ongoing monitoring. Businesses should consider ongoing monitoring of existing customer profiles, as it’s vital to pay attention to even subtle changes in user behavior, geolocation, and IP location.

Transaction monitoring. This is a type of automated technology that detects unusual transactions in real-time. It conducts analysis that verifies the source and destination of funds and determines possible connections to money laundering.

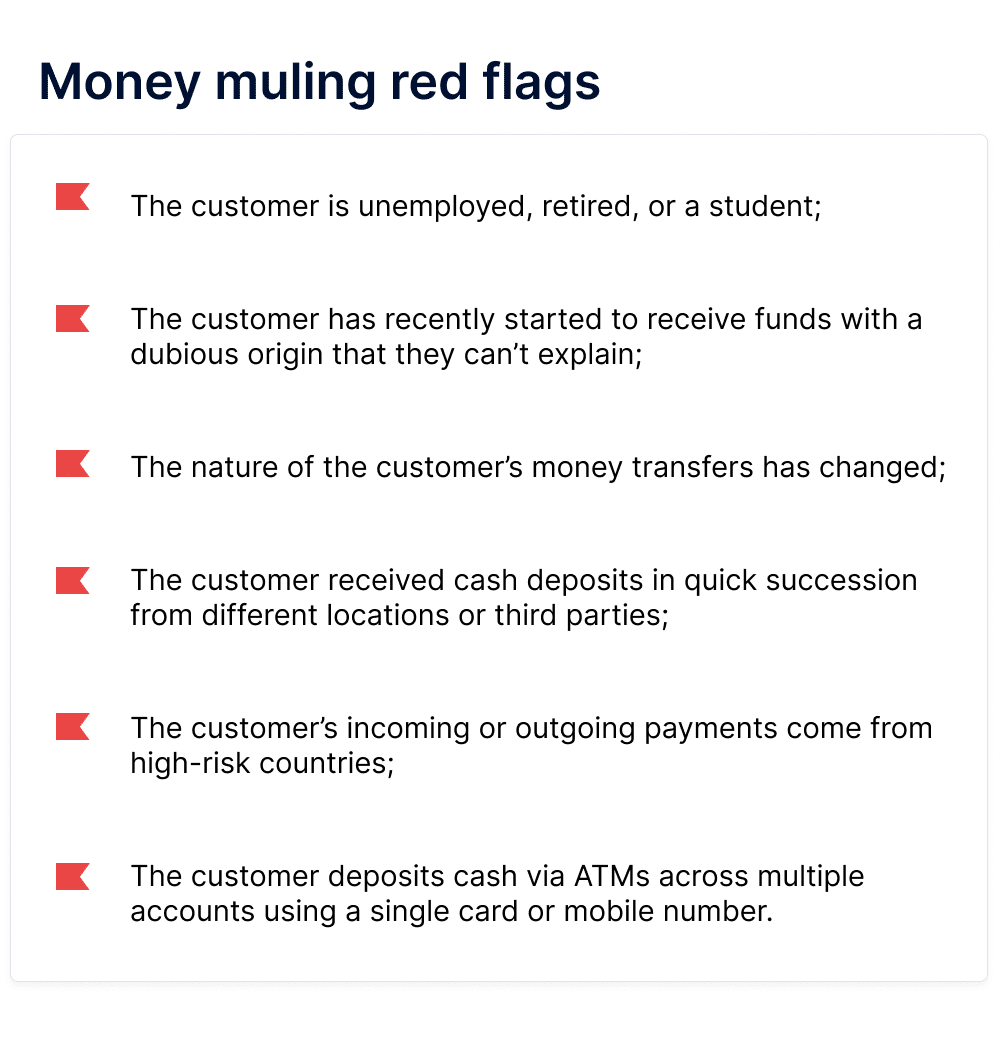

Here are the red flags of a potential money mule. The presence of a single red flag may not be a sufficient basis for suspecting criminal activity. For instance, a customer being a student isn’t a red flag in itself. But if this customer suddenly starts to make surprisingly large transactions, it might be a sign of money muling activity.

This is a checklist with the red flags; feel free to save it to your device

Overall, businesses can monitor customer activity to reduce the risk of exposure to money mules.

How to stop money mules

Businesses can’t afford to let money mules exploit them. In fact, if a business fails to detect internal money laundering activity, it can be charged with aiding and abetting these crimes under AML regulations.

If a business detects a money mule, it must report them to a law enforcement authority and freeze the account. It’s also common practice to communicate to other financial institutions that an identified person might be a mule. This way businesses can protect other institutions from known money mules.

Find more insights into existing and emerging fraud techniques in Sumsub’s fraud study (2021).

Explore more

- Regulatory compliance

- Dec 21, 2023

- 10 min read

- Verification

- Dec 14, 2023

- < 1 min read