Risk Management in Fintech and How Artificial Intelligence Can Help

Learn how to build an efficient risk management process for fintech companies.

Fintech is currently facing huge financial losses worldwide. In 2022, the market capitalization of the industry fell to $156bln, while 70% of financial institutions lost over $500k to fraud. In these difficult times, it’s essential for companies to develop an efficient risk management process to mitigate further losses.

In this article, we explain how fintech companies can improve their risk management procedures, the types of risk management out there, and how AI can be used to minimize risk.

What is risk management?

Risk management is an ongoing process of identifying possible business risks. The process is essential for any business relationship, especially in the fintech industry. However, the risks that companies face can differ—for instance, depending on the countries or industries where they operate—which means there’s no one-size-fits-all approach.

Over the past few years, the technologies used by fraudsters have advanced, leading to more dangerous schemes and greater risks for companies—particularly in fintech. Therefore, the industry should thoroughly develop its risk management systems to confront this new reality, covering the following key points:

- Regulatory risk

- Anti-Money Laundering (AML)

- Countering Terrorist Financing (CTF)

- Fraud risk

- Consumer risk

- Merchant risk

- Outsourcing risk

Types of risk management

Companies face a variety of risks, which can be classified in the following manner:

- Liquidity risk

- Inflation risk

- Tax risk

- Opportunity risk

- Longevity risk

- Market risk

- Compliance risk

For each type of risk, a company can employ one of these four management strategies:

- Avoidance

- Reduction

- Transfer

- Retention

Risk avoidance is the process of refusing to participate in a financial activity that causes a given risk. This typically takes place when a company expects the risks to be much higher than the possible benefits of a given arrangement.

Risk reduction is when companies attempt to predict and reduce risks typically at the early stage of any business relationship. This can be achieved by creating a standardized set of terms for partners, working towards contract negotiations on favorable conditions, and more. Other examples include implementing safety protocols and performing regular maintenance on equipment or systems.

Risk transfer is when companies share the risks of a business relationship with another company. Typically, a company can outsource some certain areas of risk to a specialized third party. A good example is when companies outsource customer verification to specialized KYC providers.

Risk retention is when companies insure against various risks they may face. This could be paying for employee health insurance to avoid potentially heavy medical costs, setting up contingency funds, and accepting higher deductibles on insurance policies

All these risk management approaches should be integrated by companies in order to minimize risks.

Challenges in fintech risk management

- Shifting regulations (e.g., GDPR, PSD2, MAS). Governments have been working for decades to improve and adapt the regulatory environment to shifting realities—for instance, the rise of crypto usage. This means that companies need to stay on top of changing regulations as part of their risk management procedures.

- Third party risks. Many fintech companies either use third party providers or perform such functions themselves. When properly delegated to, third parties can facilitate risk transfer. However, if not properly governed, third parties can instead pose additional risks. That’s why regulators all over the world are working towards a more robust regulatory framework for third parties.

- Cybersecurity. The fintech industry deals with an enormous amount of money, which is why hackers increasingly attack companies to obtain sensitive data. Therefore, cybersecurity risks are by far the greatest threat to fintechs, leading companies to spend big on protecting themselves. Yet, large cybersecurity spending isn’t the cure-all; some of the key risks that remain include credential compromise, not enforcing zero trust, and exploited vulnerabilities that are caused due to leaky patches in systems.

These three challenges demonstrate that fintech companies need to develop an efficient risk management framework in order to avoid financial losses, even if this means additional costs at the initial stages.

Creating a risk management process with AI technologies

AI has been around for many years, but the last few months have shown the potential the technology has. AI can be used to automate certain fintech industry practices in a way that minimizes risk levels and maximizes profits. For example, trading companies can use AI to more accurately predict customer investments by analyzing their behavior. AI can also help with:

- Fraud detection

- Market analysis

- Automation of compliance and regulatory checks

- Customer risk assessment

By analyzing huge amounts of data on patterns and user behavior, AI can allow fintech companies to focus on their core tasks. For example, companies can implement AI for customer verification to improve automation and fraud detection.

Fintech niches that need AI

AI can be used in almost any facet of the fintech industry. This includes:

- Customer verification – companies can customize their processes by using a verification provider that uses AI technologies. This way, a company will be able to quickly onboard customers and detect criminals

- Transaction monitoring — by analyzing user behavior, AI can reveal deviations in client’s transaction patterns to detect suspicious activity

- Digital banking – AI can automate many processes for apps and digital banks, which are known for their openness to new technologies

- Chatbots – AI natural language processes can improve customer interactions while not involving more human resources

- Analytics – AI can predict future industry trends, as well as market developments. It can also analyze customer behavior and report anomalies

- Blockchain – AI can be combined with blockchain technology to provide even more security during transactions.

To put it shortly, AI can reduce a variety of costs, while increasing a company’s potential in almost any field. Even if AI technologies are still being developed, it’s already clear that they can be highly integrated into a company’s workflow.

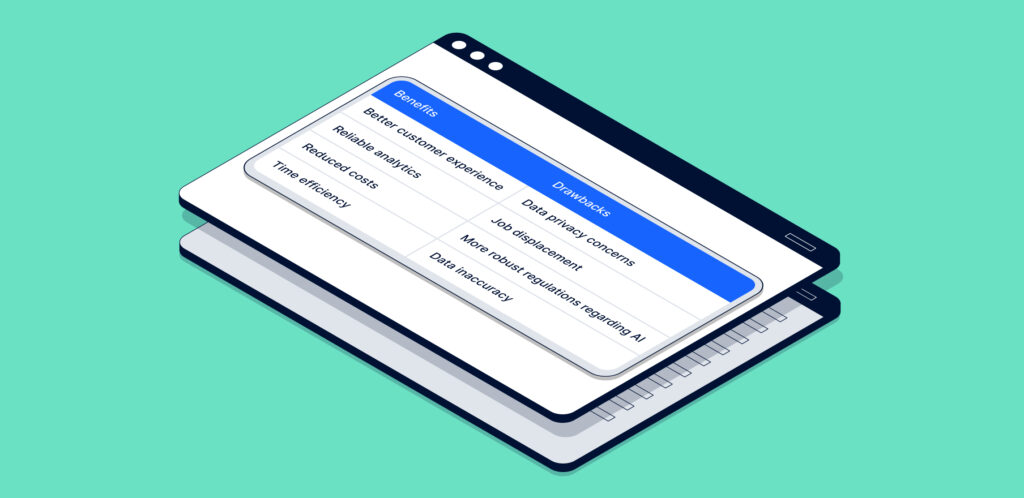

Benefits and drawbacks of AI in fintech

While AI technologies are being actively implemented in the fintech industry, there are still some risks. In the table below you can compare the benefits and drawbacks of AI solutions.

Solution for fintech

According to a Deloitte report, an efficient risk management solution should include a six-step program.

Step #1. Appoint internal management

A company should create a clear governance program explaining the roles, activities, and responsibilities of the company’s risk management personnel, who should monitor the company’s risk appetite and make sure it doesn’t go above the threshold.

Step #2. Divide all types of risks into categories

Companies can separate risks into different categories (e.g., longevity, market, tax). This way, they can efficiently distribute risk management to people specializing in each category. After this, the risks can be divided by level (high, low, and medium), allowing companies to identify the most critical problems first.

Step #3. Evaluate the company

After classifying all the possible risks by types and levels, companies should determine whether they have the means to mitigate them. To do so, companies should complete a risk and control self-assessment.

Step #4. Look out for emerging trends

Companies should evaluate emerging risks and resource management on an ongoing basis to maximize the efficiency of the risk management process.

Step #5. Understand the maturity of the risk management process

Companies should be aware of the state of maturity of its risk management. Here are some parameters:

- Existing – the risk management process is intact but basic and manual

- Evolving – the risk management process is getting more efficient as a result of an ongoing evaluation

- Mature – the risk management process is efficiently automated and properly executed across the organization

Step #6. Develop proper communication and reporting procedures

Companies should work towards collecting information from established risk metrics and delivering information to management.

Risk management means integrating many different practices and solutions, and AI is one way to simplify the process. Another way to do so is by employing a risk orchestration solution. Such a solution can also be combined with AI technologies, allowing fintech companies to customize the customer verification process to ensure that criminals won’t be onboarded.

FAQ

-

What is risk management in simple words?

Risk management is the process of identifying possible business risks and analyzing them in order to minimize losses. The main risk types are:

- Regulatory risk

- Anti-Money Laundering (AML)

- Countering Terrorist Financing (CTF)

- Fraud risk

- Consumer risk

- Outsourcing risk

- Merchant risk

-

What does risk management in finance do?

Companies use risk management to evaluate the level of risk in a given business relationship. s. This process also ensures that companies don’t go above their threshold of risk.

-

How is AI used in fintech?

Fintech industry is already using AI in the following fields:

- Fraud detection

- Market analysis

- Automation of compliance and regulatory checks

- Customer risk assessment

Explore more

- Fintech

- Aug 25, 2023

- 6 min read