The 6 Most Popular Forms of Money Laundering in Casinos

This article explains how criminals abuse casinos for money laundering purposes.

Gambling can be a haven for money laundering. And if casinos fail to detect it, they can face penalties and have their license revoked. The hottest scandal of the moment has to do with the Star Entertainment Group in Australia, which was fined $62 million dollars for failing to stop money laundering at its Sydney casino.

Casinos have a long way to go when it comes to confronting money laundering. The most important step is to implement an efficient Customer Due Diligence (CDD) check. But this alone isn’t enough. Casinos need to learn how to notice suspicious behavior and what the most popular laundering schemes are.

In this article, we go over the six most popular types of money laundering in casinos.

Money laundering in casinos

Both online and on-premises casinos are often abused by criminals to launder dirty money. The Financial Action Task Force (FATF) identifies nine potential vulnerabilities that casinos might have in terms of money laundering. They include:

- Cash payments

- Receiving proceeds of a crime

- Prepaid cards

- Deposit accounts

- Transferring money between customers

- Multiple accounts

- Multiple operators

- Identity fraud

- Third parties

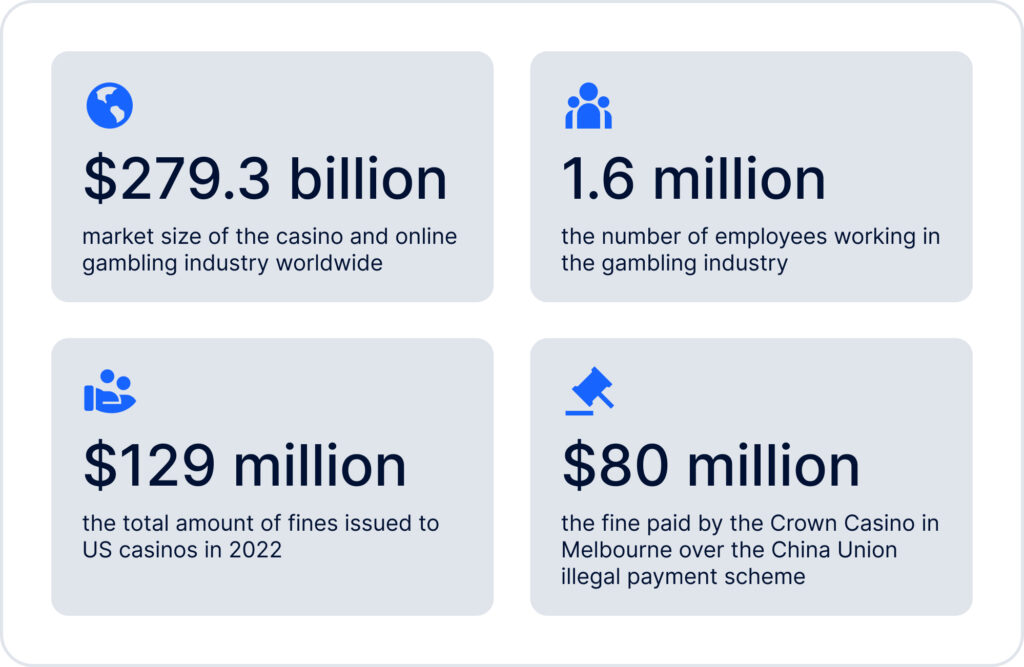

Money laundering statistics

Popular money laundering schemes

Money laundering can take up different forms at casinos. Below are some of the key examples:

Cash-in, cash-out

This is the simplest, most typical method of laundering money at a casino. A criminal simply exchanges their money for playing chips and then converts them back into cash. This way, dirty money can get mistaken for money won at a casino. Some players may even divide money into several different betting accounts, which will make them appear less suspicious. However, the simplicity of this approach also means that it’s easily detected by the authorities. For example, in 2013, a professional gambler was charged with almost $500,000 in illegal financial transactions, which were made through the good-old cash-in, cash-out scheme.

Collusion between players

This strategy requires one player to ‘lose’ all their dirty money to another player, who they’re in collusion with.

The Vancouver Model

Between 2008 and 2018, casinos in Vancouver were used to launder large sums of money from China. Since Chinese citizens are restricted from bringing more than $50,000 out of their country, criminal groups in Vancouver offered them a workaround. Instead, they could wire a large sum of money to the Chinese bank account of a Vancouver-based crime syndicate, and receive cash in exchange upon arrival to Vancouver. The visitors could then take this cash to a Vancouver casino, make a few small bets, and then withdraw it as “winnings”—cleaned of its illegal source.

Buying someone else’s chips

People can try to clean their money offering to purchase casino chips from gamblers at a favorable price. Sometimes, these criminals can even pay off a player’s debt, expecting to get repayments in the form of chips later.

Abusing gambling accounts

Some players can simply use their gambling accounts as a replacement for traditional banks. To do this, both the seller and the buyer conspire to transfer money between their respective gambling accounts under the guise of ‘winnings.’

Combining gambling and non-gambling methods

More advanced criminals further conceal traces of money laundered through casinos by involving virtual assets (cryptocurrencies, NFTs) or property purchases. By doing this, criminals attempt to confuse the authorities by obscuring the origin of the funds. Sumsub has already written about money laundering in art and vehicle sales. You can read them to learn more about different types of assets used to launder money.

Red Flags

The FATF provides a list of red flags that companies should watch out for, including:

- Transactions inconsistent with the customer’s profile

- Depositing multiple amounts of cash and receiving multiple cheques drawn on that account

- Multiple individuals sending funds to one beneficiary

- Cheques issued to a family member of a gambler

- Funds transferred into third-party accounts

- Transactions on casino accounts conducted by persons other than the account holder

- Use of third parties to undertake the structuring of deposits and wire transfers

The complete list can be found here.

The regulators

International organizations and national regulators are constantly working on combating money laundering through casinos. That’s why casinos typically have to establish policies corresponding with AML regulations. For example, UK laws require casinos to take the following measures:

- Develop appropriate AML policies

- Adopt an effective risk-based approach

- Perform Customer Due Diligence checks

- Conduct risk assessments

- Report suspicious activities

Regulators impose additional requirements for companies to fight the spread of money laundering. For example, in 2017, the UK added a rule requiring companies to assess their money laundering vulnerabilities and report whether they are at any particular risk.

Suggested reads:

Crypto Gambling Regulations in the US, UK, and Canada

Gambling in the UK: How to Get Licensed and Stay Compliant

Risks

Authorities impose harsh penalties for casinos that fail to comply with tAML laws. For example, in August 2022, the Entain Group in the UK was fined £17 million (approximately $21 million) for social responsibility and anti-money laundering failures at its online and land-based gambling businesses.

If you want to learn more details regarding the compliance procedures for both physical and online casinos, as well as the differences between jurisdictions, read our complete report on AML compliance in gambling, gaming, and betting.

FAQ

-

How are casinos used for money laundering?

Casinos are used by money launderers due to the simplicity of the money exchange process and the inability of many casinos to track down cash flow. Thus, people can exchange dirty money for chips, play with them for a bit, and then exchange them back for cash.

-

Which method is used to launder money in casinos?

There are five well-known methods of money laundering at casinos:

- Cash-in, cash-out

- Collaborating with another player

- The Vancouver model

- Buying someone else’s chips

- Using gambling accounts as banks

- Combining gambling and non-gambling methods.

-

What is the greatest risk of money laundering for casinos?

Casinos can face a variety of penalties, which might include fines and revocation of a license.

-

What are the red flag indicators of possible money laundering through gambling?

There are many red flags to look for. According to the Financial Action Task Force (FATF), some include:

- Inconsistent activity

- Multiple accounts under the same name

- Multiple beneficiaries sending money to the same account

- Checks issued to family members

- Transactions conducted by persons other than the account holder.

-

How do casinos stop money laundering?

It’s not a simple task to stop the spread of money laundering. However, companies can take measures that will help them stay compliant with regulations and minimize the number of illegal activities conducted through them. These steps include the implementation of adequate internal policies, the introduction of the risk-based approach, customer due diligence, risk assessment, and reporting. The complete guide on how to confront the spread of illegal activities can be found here.