Politically Exposed Person (PEP)—All You Need to Know

Learn how to detect and deal with Politically Exposed Persons in this guide.

Companies working with Politically Exposed Persons (PEPs) are subject to certain risks. Since PEPs are exposed to sensitive information, there’s a higher possibility that they might abuse their position. Therefore, companies should have their policies intact when working with such customers.

Sumsub has prepared a concise guide explaining who PEPs are, how to work with them, and what actions to take in suspicious cases.

Who are Politically Exposed Persons (PEPs)?

A PEP is an individual who is currently (or has been) in a powerful public position, such as a high-level politician or judge. Due to their influence, PEPs are more likely to be involved in aiding or abetting money laundering, racketeering, and financial fraud. As such, working with PEPs entails certain risks for financial institutions and other entities.

Since there is no universal definition of PEP, most countries refer to the one provided by Financial Action Task Force:

- A present or past senior government official;

- Prominent politicians belonging to a certain party;

- An executive of a governmental commercial enterprise formed for the benefit of a government official;

- Close family members of a government official;

- A publicly-known associate of a financial institution.

PEP as a term dates back to the 1990s, and is a consequence of a scandal in Nigeria where the president stole billions of dollars from the Central Bank to send to foreign accounts. Years later, a new government attempted to recover the stolen money and lodged complaints with several European agencies. The ensuing uproar over money laundering prompted global action toward preventing abuse of the financial system by politicians and high-ranking officials.

Although politically exposed persons require closer attention, being one does not automatically point to criminal activity.

There are three types of PEPs:

Domestic PEP is an individual currently or previously entrusted with a prominent public function in their country. The profile fits heads of state corporations, senior politicians, top military officials, etc.

Foreign PEP is an individual who holds (or did hold) an important public position on behalf of a different state.

International organization PEP is a high-ranking individual who is currently (or previously) appointed to a prominent position or function within an international organization.

PEP risk levels

Every regulated company has to meet the guidelines for working with a politically exposed person. After determining that a client is a PEP, companies are responsible for enhanced due diligence and ongoing monitoring.

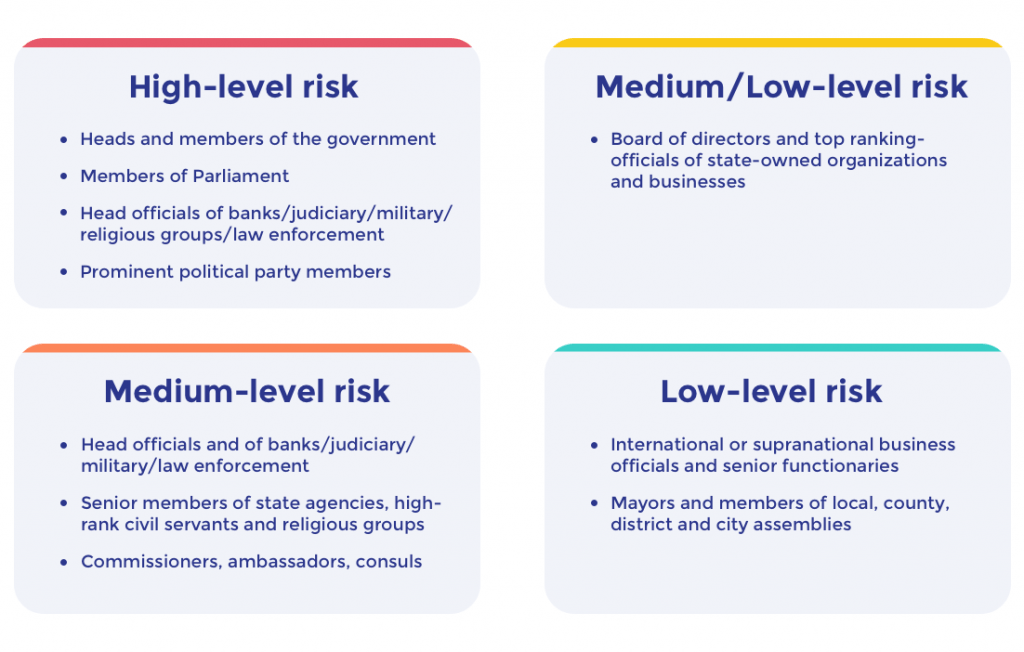

All of our PEP screenings are performed in compliance with FATF guidelines, which divide PEPs into 4 categories based on their risk level:

What is PEP and sanctions screening screening?

During the onboarding process, companies need to check whether a customer is a PEP or not. This can be done by simply asking the customer, but a more reliable approach verifies customer-provided information using PEP databases.

FATF introduced several PEP red flags that help companies detect unlawful activities. A particular country or region may also have its own PEP indicators. It is important to remember that the FATF list of red flags itself is not exhaustive, but includes examples worth paying attention to.

Some of the red flags include:

- Attempting to shield their identity and obscure ownership by using corporate vehicles, intermediaries, or introducing family members/associates as legal owners;

- Providing incomplete/inaccurate information;

- Involved in a high-risk industry/sector like banking, finance, mining, privatization, arms trade, etc.;

- Conducting suspicious transactions and financial activity;

- Having a position or involvement in a high-risk business.

Sometimes, a person may become a PEP after onboarding, and companies need to be certain that they detect such changes in a timely manner. This can be done by:

- Conducting Customer Due Diligence (CDD) on an ongoing basis;

- Training employees to detect such changes;

- Checking adverse media sources;

- Scouring commercial databases and government PEP lists.

PEP requirements

If a company works with a PEP, it should apply Enhanced Due Diligence (EDD) measures during the onboarding process and throughout the relationship. Each PEP case should be reviewed on a case-by-case basis.

How to work with PEPs

In case a PEP is detected, companies have to:

- Get the approval of senior management before establishing a business relationship;

- Verify Source of Wealth and Source of Funds;

- Inform staff members about the establishment of a business relationship with a PEP;

- Closely monitor such customers throughout the business relationship.

In case suspicious behavior occurs, companies should immediately report the case to the relevant governmental agency.

FAQ

-

What is considered a politically exposed person?

From an AML perspective, PEPs or politically exposed persons are high-risk customers with more opportunities than ordinary citizens to gain assets through unlawful means like money laundering and bribe-taking. Classifying a potential client as a PEP doesn’t mean a company can’t work with them at all. PEP identification is only part of the risk assessment process that financial institutions and DNFBPs (Designated Non-Financial Businesses and Professions) must follow.

-

What are the three types of PEPs?

The three types of PEPs are domestic, foreign, and international. Companies may apply different measures when working with each type of PEPs.

-

Who is considered to be a close associate of a PEP?

This may include any direct relatives (e.g., children, parents, etc.) or those related through marriage (or a person considered to be equivalent to a spouse), as well as business associates.

-

Why is a politically exposed person (PEP) considered to be high risk?

Because they may have access to sensitive information and/or may abuse their power to conduct illegal activities.

-

What is PEP for KYC?

Know Your Customer (KYC) procedures should allow you to establish whether customers are Politically Exposed Persons (PEPs). This can be done by conducting Customer Due Diligence (CDD), training employees, and checking information from adverse media, governmental PEP lists, and commercial databases.

Explore more

- Regulatory compliance

- Dec 21, 2023

- 10 min read

- Verification

- Dec 14, 2023

- < 1 min read