Real-Time ID Verification

ID verification is used by thousands of companies worldwide to comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, improve risk management, and prevent fraud.

The procedure includes documentary verification (checking of the authenticity of physical identity documents) and at a higher level non-documentary verification (matching the identity information against various databases, sanctions registers, and blacklists).

Fields of Application

- eCommerce

- Gambling

- Sharing Industry

- Trading

- Finance

- Online Education

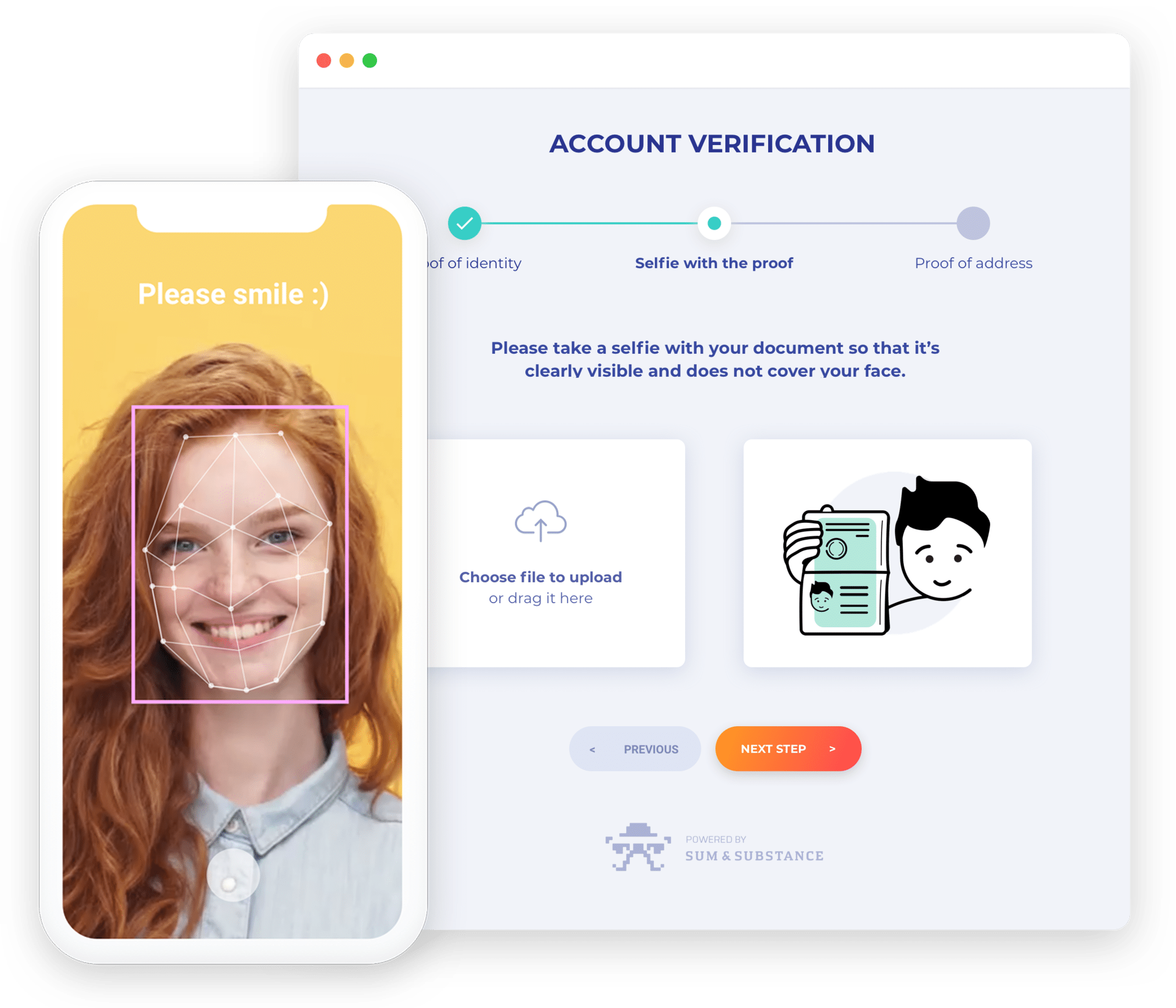

The Sumsub ID verification solution comprises the latest AI-based technology that features computer vision and machine learning.

How it works

Acquisition

- Auto select of the best angle for ID capture

- Front and back ID scanning

Retrieval

- Smart data extraction: recognition of handwritten and crumpled documents

- Autofill

Verification and validation

- Integrity and authenticity check

- Validity check

Let’s do it the Sumsub way!

- Nicely: The platform is designed to make the user enjoy every step of verification.

- Effortlessly: Flexible automation allows to reduces manual workload by 60-90%.

- Smartly: The checks can be performed via single and multi-account web SDK, mobile SDK, API, widget, Android, or iOS.

- Safely and securely: All customer and related data is encrypted and protected, in accordance with GDPR, PDPA, and CIS (FZ-152).

Explore more

- Regulatory compliance

- Dec 21, 2023

- 10 min read

- Verification

- Dec 14, 2023

- < 1 min read