Automated KYC onboarding solution

Speed up onboarding with automated KYC verification

Welcome more clients with a fast and secure automated customer onboarding process that reduces the manual workload for your compliance team

40%

cost reduction

30 secs

average verification speed

70%

less time spent on compliance tasks

Cut costs and eliminate human error, while allowing your team to focus on what matters most.

Quickly verify applicants in any number, no matter their language or location.

Easily detect bad actors with multilayered protection based on AI algorithms.

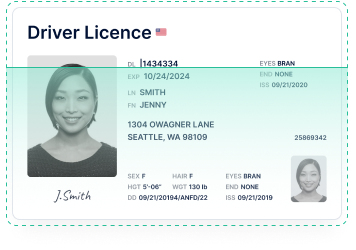

User-friendly verification that takes less than a minute

Customer onboarding automation reduces the risk of losing applicants. With no forms to manually fill, instant document pre-checks and real-time tooltips, your applicants will get verified on the first try

This is the standard flow. You can customize your own

A flexible solution that fits your KYC/AML policy

95% automation means that you can devote resources to the most demanding customer profiles

Get the power to verify over 14 000+ kinds of documents issued in 220+ countries and territories. Ease user journeys with localization to 30+ languages.

Reveal graphic editor traces, detect spoofing attempts, screen a blocklist of 1m+ fraudsters, and uncover potential fraud activity with behavioral risk scores.

Minimise risks to work with illegit users thanks to ongoing AML monitoring against global sanctions, watchlists, PEPs, and adverse media.

Easily integrate your tech stack with Sumsub

Use Sumsub to integrate the services you need via Web SDK, Mobile SDK, or our RESTful API.

Don’t worry about interruptions with 99.9% uptime.

Don’t take our word for it.

Here’s what our clients have to say

Chief Marketing Officer at Nicehash

We have a huge number of users, so manual verification would simply not be possible. Sumsub takes a huge workload off our side, which is a big advantage for us.

Need the Ideal Solution?

Choose G2's Top Pick

Compare and see how we excel beyond our competitors in key areas, as

validated by user reviews on G2

FAQ

- What is automated KYC?

Automated KYC onboarding typically involves biometric identity verification, document recognition technology, and data analytics to ensure accuracy and regulatory compliance. The process enables businesses to deliver faster onboarding with reduced manual errors, improved compliance, and a seamless customer experience.

- How can you automate the KYC process?

The Know Your Customer (KYC) process is automated by collecting user data and implementing ID document capture for verification purposes. Full automation requires biometric technology that performs liveness and Face Match verification, plus the latest non-documentary and database verification processes that create seamless checks worldwide in the fastest time possible.

- What are the benefits of automated KYC?

The main benefit of automated Know Your Customer (KYC) is that it allows companies to onboard users remotely and securely. Automated KYC solutions also ensure compliance with regulatory requirements and protect against fraud while keeping user conversion rates high. Automation helps companies maintain a positive return on inverstment (ROI) since they must protect themselves from money laundering, terrorist financing, and regulatory penalties while implementing the most efficient use of resources.