Money Laundering and Its Impact on Business

Learn what money laundering is, why it’s harmful for businesses and the economy, and how companies can protect against it.

Money laundering (ML) damages businesses, the investment climate and overall economic growth. It promotes crime and corruption, dramatically decreases efficiency of the real sector of the economy, and leads to a host of other consequences.

The global scale of ML is vast. According to the United Nations Office on Drugs and Crime (UNODC) between 2 and 5% of global GDP is laundered each year, which amounts to between $754 billion and $2 trillion.

In most jurisdictions, ML is a serious crime punishable by imprisonment and/or significant fines. For example, in the USA, the penalty for involvement in ML can reach $250,000 and up to five years’ imprisonment.

Some businesses may not even be aware that they’re being used for ML. Although not all businesses may be held responsible for ML conducted through them, AML-obligated entities, such as banks, are. And if the crime is detected during the audit process, huge consequences can result. Recently, Danske Bank was slapped with a €470 million ($495 million) fine in an international money laundering scandal.

To protect your business from criminals and regulatory fines, let’s explore what ML is, common schemes and how it can be prevented.

Money Laundering: what it is and why it matters

Money laundering (ML) is the process of concealing the origin of money obtained from illicit activities, like drug trafficking, bribery or fraud. The purpose is to introduce illicit funds into the financial system under the guise of ‘clean’ money, so that criminals can use it without attracting undesirable attention from authorities.

The fight against money laundering (ML) is often linked to efforts against terrorism financing (TF), because both ML and TF involve redistribution of the funds.

According to the Eurojust report, cases of money laundering have dramatically increased since 2016 and are expected to grow further, causing harm for business.

According to the FATF, $1.6 trillion are laundered each year from lower-income countries—most often the proceeds of political corruption. Corruption deepens poverty in such regions, also leading to environmental degradation and economic stagnation. Given the close link between ML and corruption, any efforts to limit the spread of illicit money also plays an important role in lowering corruption worldwide.

The 3 basic stages of money laundering

There are three stages of money laundering introducing laundered funds into the financial system:

- Placement

- Layering

- Integration/extraction

Money laundering stage #1: placement

Placement of illegal funds into the financial system may happen directly or indirectly.

The most popular method used in the placement stage is to divide large amounts of cash into less suspicious smaller sums, which can then be deposited into a single bank account or several bank accounts (which could involve the ‘smurfing’ technique).

Smurfing often occurs through money service businesses.

Other placement methods include:

- False invoicing (over-invoicing and pseudo-invoicing for payment of non-existing goods or services)

- Blending illegal money with legitimate money

- Buying foreign currency

- Buying securities or insurance with cash

- Gambling and betting on sports events

Money laundering stage #2: layering

“Layering” is the process of separating illicit money from its source and creating “layers” of transactions to confuse an audit. The purpose is to hide the origins of illegally obtained assets. This stage is considered to be the most complex, as it involves multiple transactions, often including international money transfers.

For the purposes of layering, money can be moved through the purchase and sales of investments, or through a series of accounts at banks in different countries. Most often, such funds are directed to jurisdictions which have loose AML regulations or do not cooperate with AML investigations.

The most “popular” examples of the layering:

- Investing in real estate

- Reselling high-value goods

- Transferring funds between countries

- Chain-hopping (converting one cryptocurrency to another, and moving crypto from one blockchain to another)

and a number of others.

Differences between placement and layering

While placement injects illicit funds into the financial system, layering hides the source of these funds through a series of transactions and financial tricks.

Money laundering stage #3: integration

After placement and layering, criminals then integrate—or, in other words, “return”—illicit money to themselves in a way that appears “clean.” If this stage is successful, the funds are now part of the legitimate financial system, and can be used freely.

The main objective here is to integrate the money without drawing the attention of the law enforcement. This can be done, for instance, by purchasing property, art, jewelry, or luxury automobiles.

The impact of money laundering

Here are only a few of the negative consequences that ML brings to business:

- Loss of revenue

- Reputational harm

- Multimillion-dollar fines or license suspension by regulators

Moreover, money laundering has damaging socio-economic effects worldwide, including:

- Fueling corruption

- Increasing crime

- Undermining trust of foreign investors

- Widening the gap between the rich and the poor

- Slowing economic growth

Common money laundering schemes

Criminals use all available financial instruments—from NFTs to real estate—to make their illicit funds look legitimate.

Gambling, gaming and betting

Gambling and betting (both online and offline) are often used to launder illicit cash.

Money laundering here takes up the following forms:

- Criminals leverage low-outcome bets to deposit dirty money and withdraw it as “winnings.”

- Money obtained from illegal sources is used to sponsor betting as a leisure activity.

- Criminals directly invest in or acquire betting shops.

Suggested read: A Global Guide to AML Compliance in Gambling, Gaming, and Betting (2023)

Money mules

A money mule is a person “hired” by criminals to launder illicit proceeds. Mules usually have a good banking history and reputation, which allows them to move dirty money without being noticed.

Money mules are recruited through online job offers or dating sites. Criminals can lure individuals by promising easy money or creating job adverts that appear like legitimate offers.

Suggested read: What’s Money Muling and How Does It Affect Businesses?

Sports

There are many ways to make—and therefore launder—money on sports: from sports betting to sponsorships to action figures. The higher the profit from these activities, the higher the risk of money laundering.

The most vulnerable sports include football, cricket, rugby, horse racing, motor racing, ice hockey, volleyball and basketball.

Here is how criminals use football to clean dirty money:

- Purchase and sale of football clubs

- Player trades

- Involving football agents in ML schemes

- Sale of player image rights

- Forgery of ticket sales

Suggested read: How Money Is Laundered Through Football

Detection and prevention of money laundering

To keep businesses safe, a thorough AML compliance program must be in place. It should define how the company detects, assesses, and reports financial crime, including the following measures:

- Customer Due Diligence (CDD). Before a customer is allowed to use the service, they must go through a Customer Due Diligence check. This involves obtaining the customer’s information to verify their identity and evaluate whether they are involved in any crime.

- Enhanced Due Diligence (EDD). In cases of higher money laundering risk, companies apply what is known as Enhanced Due Diligence. One of the most vital components of EDD is checking clients’ source of funds to ensure that they don’t come from illegal activity.

- Ongoing customer monitoring. This is an extra layer of risk management that involves ongoing due diligence checks on customers and scrutiny of their transactions.

- Independent AML audits. These allow businesses to detect deficiencies and failures in their AML strategies and correct any problems before regulatory inspections to prevent fines.

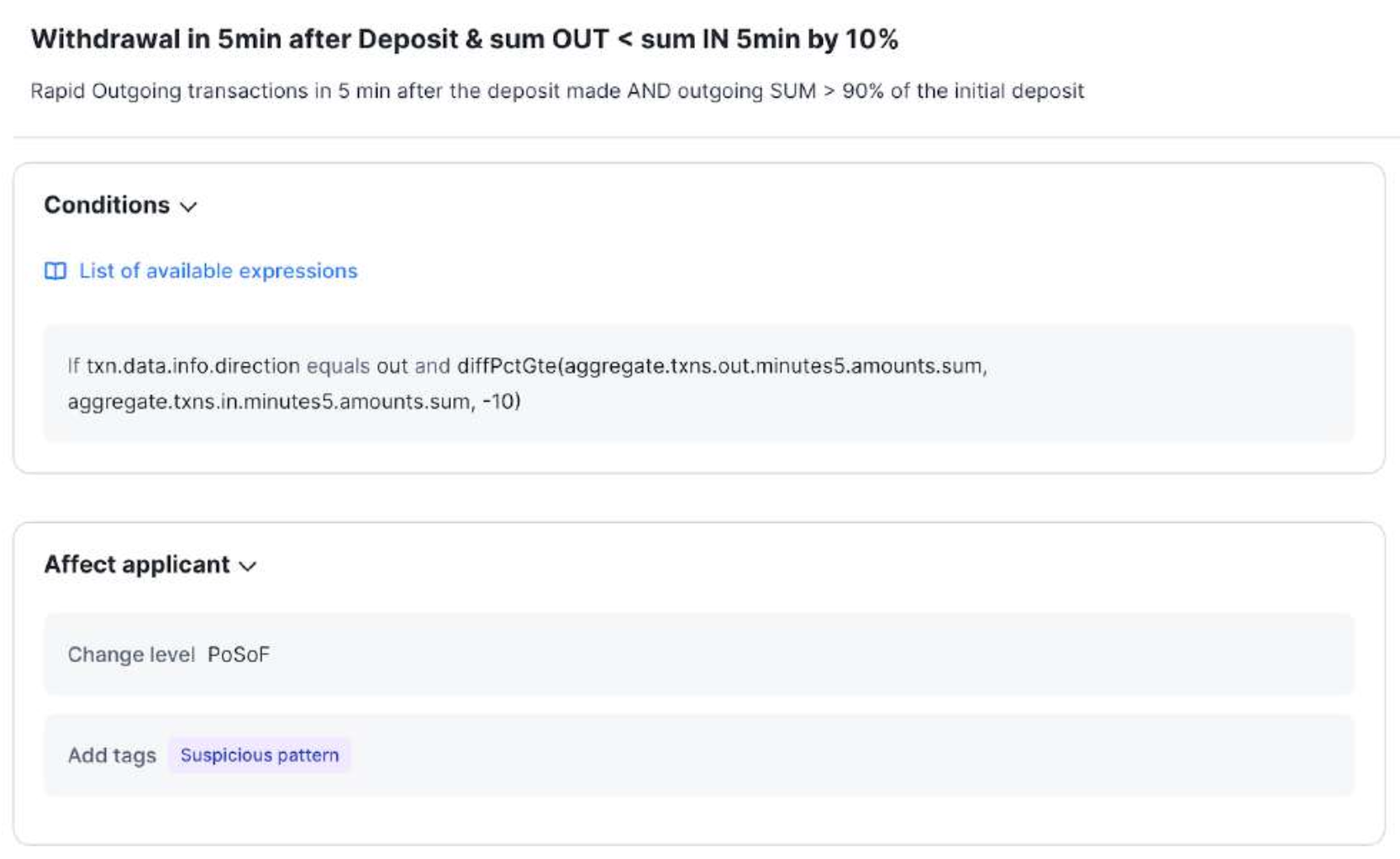

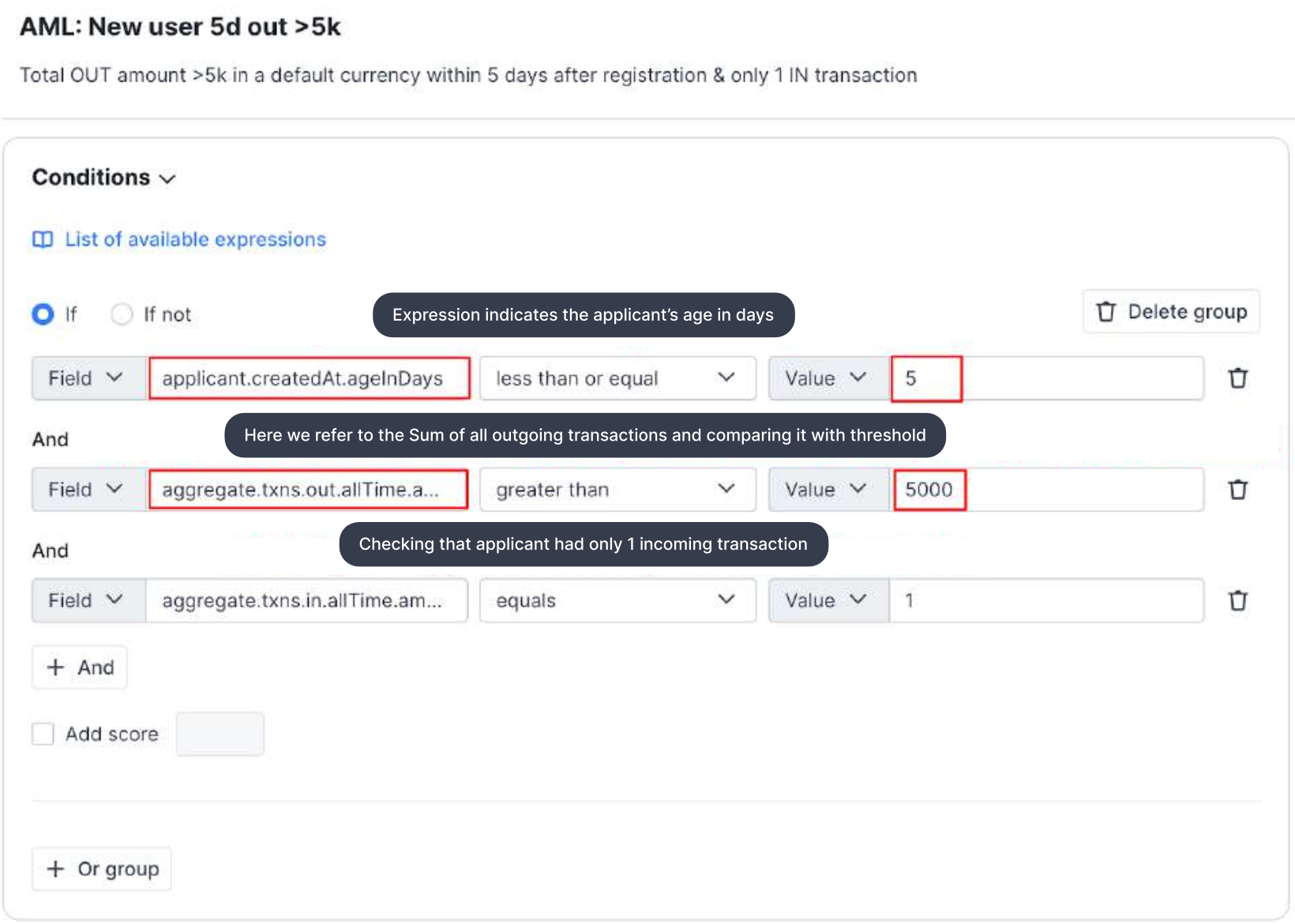

- Transaction monitoring. Transaction monitoring is an ongoing security process that helps detect suspicious transactions. A reliable Transaction Monitoring software spots unusual patterns and reviews dubious transfers and transactions made in digital or fiat currencies.

If businesses don’t monitor transactions, they risk money laundering, fraud, and other crimes occurring on their platforms. That’s why governments have been tightening their anti-money laundering (AML) regulations, and businesses that fail to comply can face hefty penalties and reputational harm.

As an example, between 2012 and 2017, Santander neglected to effectively monitor and maintain its AML processes, severely impacting account monitoring for more than 560,000 corporate clients. After an investigation, the FCA fined Santander UK Plc £107,793,300.

In 2022, Danske Bank was fined €1.82 million by the Central Bank of Ireland. Danske Bank’s failures were linked to out-of-date data filters within its automated transaction monitoring systems, resulting in 348,321 transactions being processed without adequate AML and counter-terrorist financing (CTF) monitoring between 2015 and 2019.

Subscribe to continue reading

Enter your email address to get access to the full article