KYC in Trading: 4 Common Challenges

From money laundering to insider trading, we explain the main threats to the trading industry and share tips on overcoming them.

We’ve all gotten used to fraudsters targeting banks and crypto, but trading platforms are attacked no less often. While the trading industry faces common issues like account fraud and money laundering, it also has significant industry-specific challenges like insider trading and market manipulation. This article will help you identify these risks and learn how to avoid them.

Challenge #1: insider trading

Insider trading is the disclosure of non-public information that’s unavailable to other investors in order to gain an unfair market advantage. Cases of insider trading happen every day and, if undetected, can cost companies hundreds of thousands of dollars in fines.

How to avoid it:

Verify your employees. Employee verification is a background check on potential employees that determines prior cases of misconduct.

Focus on company ethics. Employees must be aware of information considered confidential and the penalties for its disclosure.

Monitor trading activity. Suspicious trading could be a signal that someone is using insider information. For example, if someone buys a large amount of certain shares the day before a company does the same, it could be an insider trading red flag.

Challenge #2: market manipulation

Market manipulation covers a range of activities aimed at artificially affecting stock prices.

Market manipulation activities include:

- Layering or spoofing—creating false impressions of demand in the market by placing multiple non-genuine orders;

- Wash trading—selling stocks to oneself (sometimes through third parties) with the intention of showing interest in the market;

- Squeezes or corners—acquiring a dominant position and forcing other traders to buy at inflated prices;

- Pump and dump—boosting stock prices by creating a fake positive image for investors and later dumping shares by selling them at inflated prices.

How to avoid it: Brokerage firms need to look out for suspicious activities on their platforms and develop a set of policies and procedures to minimize the risks of market manipulation.

Signs of suspicious activities may include, but are not limited to:

- Unusual size of orders;

- Unusually short time span of orders;

- Consistent orders that contradict market behavior;

- Orders placed above market price.

Implement the following measures to detect market manipulation:

- Employ pre-trade controls for customers that exceed certain limits (e.g., credit limits or maximum size of order limits allowed by a company);

- Develop a framework to investigate suspicious activity.

If a trading company finds out that its service has been abused by market manipulators, the company should file a report with the respective authority.

Challenge #3: account fraud

Account fraud is when fraudsters steal an identity for financial gain. Such fraudsters may use trading platforms in several ways:

- Stealing an existing account. By obtaining personal information, fraudsters can log into a user’s account and steal their money and funds;

- Creating multiple accounts. Fraudsters can use several stolen IDs to benefit from bonuses, referral programs, or signups;

- Using a fake account for money laundering purposes. A fraudster can steal an account or create a fake one to trade using illegally acquired money.

Many trading companies may lack proper security policies to detect account frauds. For example, in July 2022, brokerage firms UBS Group AG and JPMorgan Chase & Co. agreed to pay a fine of $2.1 million for a lack of sufficient policies and programs to prevent account frauds.

How to avoid it: Trading platforms should implement identification and verification procedures for onboarding customers. They include:

Another way to check if a customer is authentic is the payment method check. This process compares the data provided by a customer to the one from the bank account. This procedure can take place during the onboarding stage or before the first transaction. Payment method check allows a company to ensure that a customer is a legitimate cardholder.

Contact Sumsub today to get efficient verification solution and account fraud protection.

Challenge #4: money laundering

Money laundering is one of the most widespread problems in the trading industry. Trading companies often end up being abused by criminals for money laundering purposes. For example, in 2021, fraudsters used several online investment platforms to launder more than $100 million from COVID relief funds.

As a result, regulators strictly monitor the industry, fining brokers millions of dollars for failures in regulatory compliance. The case of TJM Partnership, which had to pay a £2 million fine, is an example of a weak Anti-Money Laundering (AML) program.

How to avoid it: Brokerage firms should implement proper AML policies and KYC procedures to stay compliant with regulations and prevent criminal activity on their platforms.

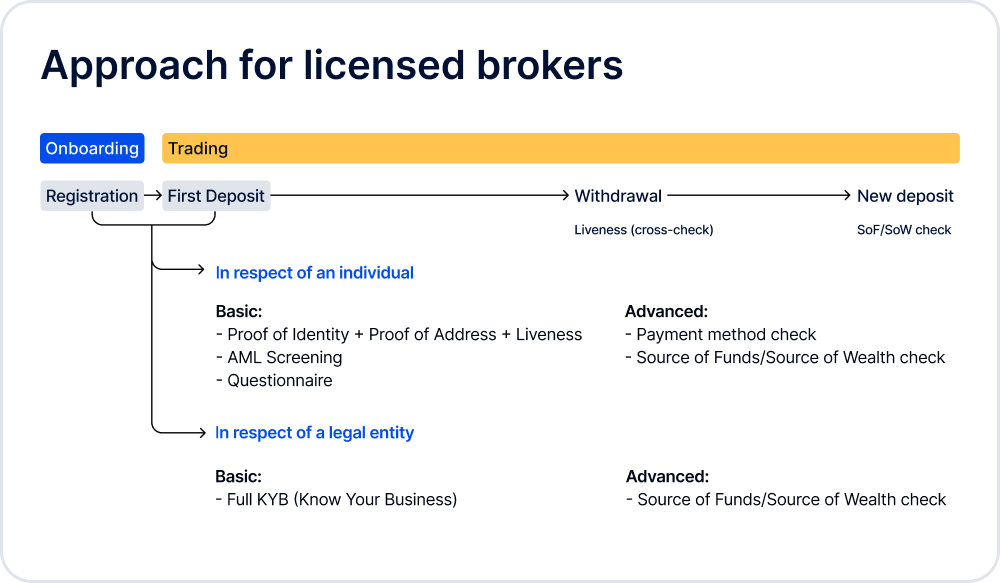

However, KYC tools can negatively affect the conversion rate due to a potentially longer verification process. To prevent this, companies can adopt a three-step strategy:

The third step suggests the division of the checks into several stages:

- Onboarding checks;

- Ongoing checks.

Onboarding checks identify and verify new customers ensuring that they don’t pose risk to the company. The standard set of checks includes:

- ID verification;

- Liveness check;

- Proof of address;

- Sanctions screening;

- AML screening;

- Questionnaires;

- Bank card verification.

When a trading company registers a business, it should request additional documents. Such documents may include financial details (annual income) and proof of sources of funds and wealth (salary or real estate).

Ongoing checks can be separated into document monitoring and AML screening. Ongoing document monitoring is a periodic document review based on best practices determined by the trading company. Ongoing AML screening is needed to check whether customers appear in any of the sanctions lists (OFAC, UN, HMT, EU, DFT, etc.), PEP lists, adverse media, and so on.

Conclusion

Trading companies face many client-related risks. The best way to minimize them is to develop an efficient set of internal controls and create a proper customer verification flow. To do this, companies should consider using a KYC provider.

Explore more

- Regulatory compliance

- Dec 27, 2023

- 6 min read